Visit my new site

Rawlingsunday.com

To read my latest post and share or comment and follow me to get my latest post too. This account will soon be deleted.

Visit my new site

Rawlingsunday.com

To read my latest post and share or comment and follow me to get my latest post too. This account will soon be deleted.

Check out my new blog post here( SEVEN WAYS TO ACHIEVE FINANCIAL FREEDOM) and comment here:

Rawlingsunday.com

Will be deleting this account soon.

Thanks for following my wordpress page. I will like to inform you that I have moved to

Rawlingsunday.com

A lot of opportunities have passed you by that can lead to your financial freedom, but you have put that off yourself one way or the other because you are not aware that a good opportunity that can turn you around have passed you by. The road to financial freedom need vital steps, decision and action that can turn things around for you. Its not a smooth path but with steps taken you get there. In these steps, you might meet people along the way that might discourage you or make you see reasons you need to enjoy now and forget about later. These little things you take for granted hinders you from being free financially, but you never take note of them.

You don’t think of financial freedom because you don’t talk of money or see money as lack or hard to get or everyone around you share the same mindset so you look at it as normal and no need to act or take actions. Most times, you are being tired down by one story that has held you down and you find it hard to navigate around and move forward.

It does not matter how much money you make, if its not well managed and no level of discipline and commitment to achieving your financial freedom you end up struggling financially. Its one thing to think of financial freedom and a way to leave the rat- race it’s another thing to act and be committed to it.

How have been your attitude towards money, you need to review how you think about money or else you will still be stuck in the same position, struggling to break free from the rat race.

Once you have these questions in mind or have the right answers to these questions, you will know why you are where you are financially and why you are there and if you really want to make a change or want to remain where you are. If you want to step up or work out more ways to your financial independence or you want to keep earning the same amount or you want to change that amount, there are many more to thinking of your financial freedom and many more hinderances to it.

There are hinderances to financial freedom and they are:

FEAR

When fear cripples your mind, it hinders your decision making and not getting it right. Fear hinders you from creating wealth or having more. It places limits around your thoughts and you are crippled to stay in one position and enjoy life in that confinement. If you are tied down to a confinement you can create a financial plan or think of setting financial goals or even come near being financially free.

Fear of your debt cripples you and hinders you from even thinking of saving or investing because you feel you will never finish paying off your debt or not knowing where to start or even plan for your retirement.

When you are fearful about your financial freedom, you must have doubted yourself a lot and when you doubt yourself you are short of ever thinking of reaching your desired financial freedom.

UNCERTAINTY

When you are filled with doubt, you are uncertain about your financial freedom and your future. If you are certain about your financial goals, you will surely know how it will turnout for you because you are organized and plans for your current situation and the future. You spend more time doubting yourself and your thoughts is pre-occupied with money scarcity, worries about your finance and how to move from one position to another and you are still swimming in the rat-race struggle.

With uncertainty, your money comes in and goes out. Your spending is not even certain, you are buying impulsively and act with uncertainty about anything involving money and unstable mindset about money habits.

PROCRASTINATION

Procrastination starts with little action till it becomes a habit you develop and before you know it spreads deeper than you thought and you realize a little later than you know. It hinders your action to financial freedom because they keep giving yourself reasons why you can’t save, invest or side hustle. You procrastinate because you develop the habit of delaying your plan even after you get enlightened about an investment product or planning to save because you assume to have accumulated debt or have more expenses than you thought.You procrastinate because you develop the habit of delaying your plan even after you get enlightened about an investment product or planning to save because you assume to have accumulated debt or have more expenses than you thought.

Procrastination in paying up your debt or credit cards and your interest rate grows. You keep procrastinating to starting budgeting your finance and learning to be in control of your finance.

When you keep procrastinating, you delay your chances of working towards achieving your financial freedom or ever setting or achieving goals that help you live your paycheck to paycheck lifestyle.

LACK OF DISCIPLINE AND COMMITMENT

If you don’t have a level of discipline, you will say “YES” to almost 90% of things and say “NO” to 10% of things which affect your finance. If you don’t cultivate good financial habits you can’t achieve financial freedom. Your indiscipline and non- commitment towards your setting financial goals affects your financial future and hinders your financial freedom. You must be disciplined enough to deal with your frivolous spending and deal with your wants and manage your needs to be committed towards your goals.

LACK OF FINANCIAL EDUCATION

Your level of financial education or exposure to investing helps in your financial freedom. With your level of financial education, you would have acquired great knowledge about any product before buying it. you buy investment products most time to follow the crowd without in-depth knowledge or being enlightened or guided by anyone into what you are buying. When you start losing money like every other person, you quickly sell it off at loss. Your level of knowledge about what you are into determines your level of financial freedom. Even if don’t love reading, there’s audio tapes, seminars, videos to enlighten and assist in your financial education.

LEVEL OF THINKING

Your thinking pattern determines your financial freedom. How you think is how you become. If you think money is scarce and hard to get that is how it will be for you. With your level of thinking its not possible to achieve financial freedom. The thinking pattern makes it hard for you to save or invest and you live paycheck to paycheck lifestyle. You don’t read books or attend seminars or even listen to tapes. You rarely talk about anything relating to money. You do not realize that being financially aware of where you are and overhauling your thinking and changing your bad-habits helps your financial freedom.You do not realize that being financially aware of where you are and overhauling your thinking and changing your bad-habits helps your financial freedom.

NO BUDGET

When you have no plan for your money, your money will have plans for you and tell you what to do. That penny you earn today if well managed will grow big tomorrow and lead to your financial freedom or if not well-managed leads to financial woes.

You must begin to have plans and set goals and work towards achieving it by budgeting and letting your money know where to go and what to do with it and its outcome.

N.B: You can share or reblog this post to help enlighten other people too. Thanks.

For your financial freedom, you must be financially aware and look for ways to turn your financial woes around. Its time to start running your finance like your business and start knowing where you stand and what to do to turn your finance around. You need to start managing your money well, like knowing what goes out, what comes in, budgeting, when you have excess cash, what to do with excess cash, delaying gratification, and many more,

The road to financial freedom needs disciplined actions, financial plan and steps to break from the rat race and flee the paycheck to paycheck lifestyle.

Now than never is the time to start planning by thinking of your financial freedom and how to go about it. you need to plan for financial freedom and think start thinking of how not to get financially worried or stress about money. Now is the time to start aiming for that goal.

For your financial freedom you must ask yourself why you are not thinking about your financial future and freedom? Why you are where you are? How to be on track to your financial freedom. What you ought to do and what you ought not to. If you have not been taking charge of your finance, you need to know why you are not doing that and why is money controlling you and not you are controlling money.

Now is the time to get rid of all your toxic thoughts, your excuses and face the reality and plan your way to financial freedom. Your financial stress and woes can’t be resolved in a day, but take necessary steps and actions needed to resolve these financial struggle and project for the future. With little steps, things easily turn around for good and you will realize those days are gone but its important you make up your mind today to achieve your desired freedom.

For you to start thinking of your financial freedom, you need to sit down and make decision to become financially free and plan for your retirement

If you worry about your finance, how you work your ass off that job with stress in traffic, sometimes lateness to work, stress from the work, debt accumulated and many more, now is the time to value your financial freedom and plan for future retirement early. Now is the time to pay attention to your finance and be more detailed about your spending and think of goals for yourself.

now is the time to let go of the things holding you back, think of ways to move forward. People are really planning their financial freedom to do what they love and to retire early while you still have these set of people who still struggle with their finance and the job they hate and never think of their financial freedom till they get knocked by that job and they begin to face the reality thereof and begin to begin to pick the pieces thereof.

Your financial freedom today is your choice. It’s the decisions and action-mentality towards making that great change. Your journey towards financial freedom is about overhauling yourself and taking small steps each day towards achieving set goals that changes everything forever.

You must take control and take charge of your finance and become aware of your financial woes and know that your knowledge leads to your financial freedom. You need to know that you need to acquire skills and financial education to work towards your financial freedom to set yourself free from paycheck to paycheck lifestyle.

If you don’t take the necessary action today to plan towards your financial freedom how will your financial future be tomorrow? What will tell yourself about what you have done to yourself and how you are left in financial bad shape. Not working towards your financial can either put you in harms way, make you struggle for long, not being able to make your dream a reality, tearing your family apart and many more.

When you achieve financial freedom, you worry less about money, you don’t struggle paycheck to paycheck, your finance is organized and well-planned, you know where your money is going to and what you achieved with it so far and your next financial goals to set or achieve. Your expenses are well managed, and you can easily differentiate between your needs and your wants.

As said earlier, your financial freedom gives you that freedom from the mental slavery of your job, debt, freedom to follow your passion and chase that dream of yours that you have longed for.

What is this financial freedom I have stressed about? What is it about? How do you go about it? what is hindering your financial freedom? Why do you struggle to achieve it? why are you not really getting it right? Why have you tried a lot of things that seem not to work towards your financial freedom yet? Have you been on the right path? Where are you so far? what have you achieved in your road to your financial freedom?

WHAT IS FINANCIAL FREEDOM?

It is breaking the financial barrier and worry less about money. It’s about not living paycheck to paycheck and not being stressed about your finance. it’s about being who you are, who you want to be and where you want to be. Its about become a different personality entirely from your past and become a better person financially. It’s about growing, improving and becoming successful to be financially free. It’s an ability not to rely on an income. Its an income that do not make you rely on your job financially again. Its about having more cash flow to match your expenses. It’s about having financial plans and setting financial goals and not being financially stressed again. It’s about chasing your passion and not being financially worried.

CONCLUSION

I know you must now have a better insight into what being financial free is all about and what you really need to know about it. Why you really need to think of your financial freedom. Why you need to flee the rat-race to become financially free. Now than never you need to start planning towards your retirement and think of your passion to worry less about money.

You are never too old or young to start thinking towards your financial freedom and start planning with taking small steps to help achieve your financial freedom. To achieve it, you must be financially aware of where you are, overhauling your thought-pattern, be goal oriented and action- mentality. You must be that kind of person that is determined to flee paycheck to paycheck lifestyle. You must be entirely tired of your financial struggle and wants a turn around to achieve financial freedom. That is what FINANCIAL FREEDOM is all about.

The rich think differently from other classes of people, it’s in their attitude and habits. That is totally undeniable. You need to think like the rich to attract the right things into your life. And that is the world they live in. with the right mentality, you can manage and grow your finance but if you don’t, you find yourself struggling financially like lottery winners or people living paycheck to paycheck and go totally broke. No matter the amount won through lottery or gambling, lottery winners or gamblers don’t think like the rich and will never do until there’s an overhauling in thought.

Studying the life of the rich, you will realize that they have the same thinking pattern i.e. mentality. The thoughts they generate. Guard your mind, out of it cometh the things of your life. These people don’t follow the society way or live a life of mediocrity which is nothing but the truth. It’s because of this mentality that a few hold a high percentage of wealth in the world. Being rich is about having money and controlling it and not money controlling the person.

Its about unlearning and learning, practicing a new habit to enjoy your financial success. The ways the rich think differently from the poor is many but will focus on selected few.

11 WAYS THE RICH THINK

(1) The rich people believe hardship causes evil

(2) The rich focus on the right knowledge

(3) The rich think big about the future.

(4) The rich people surround themselves with the right people.

(5) The rich think of investing than saving.

(6) The rich take risks.

(7) The rich think of money as friend.

(8) The rich believe you make money through your thought and action.

(9) The rich think of themselves and their values.

(10) The rich think of managing their money well for their financial well-being.

(11) The rich think of solving problems.

(1) THE RICH BELIEVES HARDSHIP CAUSES EVIL.

The rich believe hardship is truly the root of all evil and has caused the death of many people. When your life experience tough times, you end up perpetrating evil and end up blaming everything around you for the hardship in your life and you never take responsibility for your life. The rich believe when you have money it makes life less complicated, comfortable and fun to live.

(2) THE RICH FOCUS ON THE RIGHT KNOWLEDGE

The rich believe in the right knowledge that sets your path to wealth creation. They don’t truly believe that formal education is the way to wealth but getting the specific knowledge, you work on it to become mastery in what you do, and it generates wealth in the long run. Their education is goal- oriented with great result.

(3) THE RICH THINK BIG ABOUT THE FUTURE.

The rich believe so much in the future that they project and plan for it by setting goals with deadline to achieve them and how to go about it. they plan and prepare for what lies ahead. They work on their dreams and plan on making their ideas a reality by projecting for the future. They create financial plan of future financial crisis and plan for events to keep to their lifestyle.

(4) THE RICH SURROUND THEMSELVES WITH THE RIGHT PEOPLE.

The right set of people guide you on the right path. The rich do not need mediocrity and negative people around them but the right set of friends to help their goals and make their dreams a reality.

With the wrong set of people who are not goal-oriented, these people will alter their goals and poison them with toxic words because of their attitude so they stay clear of these people.

(5) THE RICH THINK OF INVESTING THAN SAVING

The rich know money has lost its value due to inflation and look for ways to avoid inflation destroying their money by investing their money than saving their money in the bank and getting paid a pittance interest. The wealthy think of what to do with their money to earn more money and not live a mediocrity life.

(6) THE RICH TAKE RISK.

The rich know they cannot become rich by playing safe and being extremely too frugal, they prefer taking risk to earn more. No matter the risk if they lose they learn to plan to earn more. They take the risk to start and set-up the business than save, they prefer investing in that stock after acquiring the right knowledge than keep money in the bank to do nothing.

(7) THE RICH THINK OF MONEY AS A FRIEND

The rich think of money as friend to achieve their desired end and live a comfortable life and make life conducive for them. They look at it to achieve their financial independent and don’t have to worry about it and they can live the kind of lifestyle they want and buy things that makes them happy.

(8) THE RICH BELIEVE YOU MAKE MONEY THROUGH YOUR THOUGHT AND ACTION

The rich spend time thinking of way to creating and make more money by taking down their ideas and taking actions towards their dreams and making it a reality. They believe in spending time to think, meditate, take down their ideas on note, create and innovate and take actions to get richer.

(9) THE RICH THINK OF THEMSELVES AND THEIR VALUES.

The rich promoted themselves through what they have to offer. They promote themselves through their ideas which they are passionate about and use it to connect with people who buy into their ideas. Being able to promote themselves through their product show their value and what they have to offer.

(10) THE RICH THINK OF MANAGING THEIR MONEY WELL FOR THEIR FINANCIAL WELL-BEING.

What makes the rich think differently is how they manage their money to become financially independent. They educate themselves on how to manage their money and what to invest in to make money work for them and grow their net worth. The rich control their money and don’t allow their money to control them by educating themselves on how to pay themselves first, invest in stocks, bonds, mutual funds, real estate and many more.

(11) THE RICH THINK OF SOLVING PROBLEMS

The rich believing in solving problem to create wealth by looking for opportunities to do that. They master the act of solving problems and overcoming challenges to meet the needs of people. They are always solution oriented. They spend time to plan and strategize on how to resolve the obstacles and use it as an avenue to create wealth.

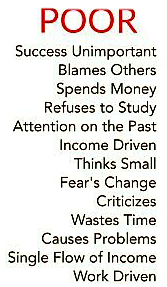

Poor is a thing of the mind. Its just a mindset, a thinking pattern that has left you the way you are and it all boils down to choices you have control over or whatever controls you.

You can start life being poor and struggling financially does not mean you are destined to remain poor or be poor. Things can change and for things to change its all about your decision and these decisions either leave you where you are or change things for you. Because of your pattern of thinking great opportunities have passed you without you being aware and it also affects your level of knowledge.

Knowing that everyday you sleep and wake, you have the same opportunity as the rich people, it’s what you do with it that really matters. Everyday or somehow, someway you have heard of mutual funds, stocks, bonds, real estate and many more and these assets mean nothing to you because of knowledge, fear, risk, doubt and many more. Because of your state of mind, you always believe there is no money and its never enough to go around.

Why are you the way you are? Why do you think in this pattern? Is it that you are unlucky? Not working hard enough and many more. Most times you wonder where these thoughts come from and how long it’s been flowing through your mind. The money decisions you have made too. Because of these decisions, you spend all, living your life in debt, make bad investment without knowledge about what you are going into, give away unnecessarily.

13 WAYS THE POOR THINK

-Work harder for money

-They believe luck makes you rich.

-People think money is root of all evil

-Poor people think you need money to make money

-Think their problem is beyond their resources.

-Poor people focus on risk and fear.

-Poor believe you must go to school to excel in life

-The poor see money through emotion

-They have no goal or low expectation

-They live beyond their means

-Money cannot make you happy.

-They get stressed out with the thought of money

-Poor financial decision making

-poor people believe you need money to make money

(1) WORK HARDER FOR MONEY

The poor always think you need to work hard to show how worthy or deserving you are and your value. You work hard for it because you also believe that is the way to become rich. You work hard and harder, get salary increase and work harder for more increase not knowing expenses increase because of your level of thinking. You work hard for safe and secure job but in the corner of your heart fear lurks in your heart. Because you don’t invest a portion of the money you worked for, you work all the days of your life, creating a thinking pattern you pass to your next generation.

(2) THEY BELIEVE LUCK MAKES YOU RICH

You believe in luck, that is the only way wealth can come to you through fate. Believing that accidentally you get lucky to become rich. You play lottery, bet, gambling hoping to make money and become rich. Whenever you see wealthy people, you think of all the luck they had which you never had and how you have tried a lot of things that did not work and feel you are unlucky.

(3) POOR THINK MONEY IS THE ROOT OF ALL EVIL

You think of all the terrible things going on the world now and you say money is the root of it all. When you are alone you think of everything as vanity and money ought to be spend and not saved. As the money comes in, it all goes out. At the end of your thought, money is always the root of all problems.

(4) POOR PEOPLE FOCUS ON FEAR AND RISK

You focus more on fear and the risk involved and you think of the mistakes you have made in one time in your life and the losses you had, fear preoccupies your mind and you won’t think of taking any risk because you think of the losses thereof. Even if you see opportunity, the fear and risk take toll on you, it gives you reason not to act. Fear preoccupies you because you have the minimum knowledge and skills required.

(5) POOR PEOPLE BELIEVE YOU NEED TO GO TO SCHOOL TO EXCEL IN LIFE

You believe to excel in life, you need to go school to get a good job and get good salary and climb up the chain in your company. You believe without formal education, you cannot excel or become rich in life. These patterns hinder your thinking of becoming rich.

(6) THE POOR SEE MONEY THROUGH EMOTION

You buy things through the eyes of emotion. You get caught in adverts in billboard, radio jingles and many more advertising, you get caught in frivolous buying, you can’t control your emotion, and this leaves you in financial scarcity believing money is hard to get and you live from paycheck to paycheck.

(7) THEY HAVE NO GOAL OR LOW EXPECTATION

You have no goal and your expectation is always low or none. You never look past your surrounding and envision for greater goals. Because of your environment, your thoughts and actions are limited. You need to get beyond your expectation and break this pattern and set achievable goals.

(8) THEY LIVE BEYOND THEIR MEANS

You live above your means because of your extravagant lifestyle that catches your attention or expenses puts you in tight corner. Because you live above your means you find yourself in debt, struggling because of your frivolous style or financial woes.

(9) MONEY CANNOT MAKE YOU HAPPY

You believe money cannot make you happy and can’t give you the necessities or luxury to make life comfortable for you. You believe it help you acquire things that makes you happy and feel how beautiful life is.

(10) THEY GET STRESSED OUT WITH THE THOUGHT OF MONEY

You always believe you will continue to manage and stress yourself financially, anytime the thought of money crosses your mind you are entirely stressed because of the expenses, debt and other bills to pay ahead.

(11) THE POOR THINK THEIR PROBLEMS IS BEYOND THEIR RESOURCES

You always think your problem is beyond you because you feel you lack the skills and capacity to manage it. Because of your level of capacity, you always try to avoid it and it makes you feel the problem can’t be solved or it’s bigger than you and you are not solution oriented.

(12) POOR FINANCIAL DECISION MAKING

Your decision making affects your finance because of your thinking pattern and those you relate with. When you make the right decision, it influence your finance positively to plan, budget towards your financial goals.

(13) POOR PEOPLE THINK YOU NEED MONEY TO MAKE MONEY

You believe that you can’t make money without money because you are wired to think so. You don’t believe in even your ideas or confident about yourself but only believe that you can only make money through money.

CONCLUSION

There are many more to the way the poor think but with the ones I interacted with these are a few I could take note of. These are the thinking pattern that left them the way they are. If only there could be a shift in thinking pattern they will become financially free.

Yon now know the difference between needs and wants and how they affect your financial decision and even financial goals if not well-managed. Why you still struggle financially is because you have not become aware of the difference between your needs and wants and how to manage or go about it, you keep experiencing financial woes. At this point in your life you should know what you need and what you want and learn to achieve balance between the two so that you can achieve your financial goals in life.

Years ago, our needs were met and we had limited wants but now the level of wants has grown more than needs because of the introduction of exceptional products and services that have eroded the market with great marketing advert positioned in places that can easily capture our mind and attention and the more money you make the more your wants increase too. With this increasingly purchasing more wants, your ability to save, invest or start your side hustle depletes and you lose focus financially.

Years back, I could not prioritize or differentiate between needs or wants, I just bought whatever I want when I hunger for it and I never delay gratification for anything till I became financially aware of my financial status and what I have been doing to myself and started working on myself to change my ideology about money. I realized that there are somethings in life I don’t really want or need, and I started trying to balance my financial life.

I once know some friend years back who was always in financial lack. Once his salary comes, its all gone because of too much wants in his life to the extent that he goes to financial institution to get loans to manage his bad debt, always living him in financial distress.

DIFFERENCE BETWEEN NEEDS AND WANTS.

(1) Needs are individual requirement that must be meet for your survival and important for your day to day existence and fulfillment of a good life. You need air, shelter and many more to survive because without them your existence is inevitable while Wants is just a hunger or desire for a product or service which is but for a passing moment.

(2) Needs are limited meaning they are restricted in size, they are few, but your Wants are unlimited because there’s always need product and services invade the market everyday to draw and capture your mind and attention and makes you desire to have the product or service.

(3) Needs is something you must possess or must have for your existence, comfortability and conduciveness while Wants is what you wish and desire to have to live comfortably and for flamboyant lifestyle.

(4) Needs remain the same; its variable or qualities under a set of given conditions always remain the same in all circumstances but Wants will always change with time if new products and services are introduced into the market to meet your needs and make desire to have the latest one in the market.

(5) if needs are not met or fulfilled, it leads to ailment and death most times but wants lives you destabilized, unhappy and disappointment for a time range.

6 WAYS TO MANAGE YOUR NEEDS AND WANTS

How do we achieve balance between needs and wants and manage them well? We need to master the art of balancing and managing your wants and needs to achieve your financial freedom. Here are ways to balance your needs and wants:

-Live simply

-Separate your needs and wants

-self-discipline

-use your time well

-create a budget

-Focus on your financial freedom.

LIVE SIMPLY

A life of simplicity can help manage your needs and wants and separate them well. To help achieve your financial freedom, a life of simplicity is very important by adjusting your expectation and living appropriately right. You need to develop the habit of living below your means to achieve financial freedom.

SEPARATE YOUR NEEDS AND WANTS

At this point in time, you should become financially aware of your financial status and know the impact of your wants on your finance and how to manage your wants and needs by separating them from one another.

SELF-DISCIPLINE

Controlling your wants and sticking to the list of your needs according to your scale of preference takes a level of discipline to achieve. It’s easier to say but it requires more effort and dedication to act on this to get the required result. You also need to maintain self-control for your frivolous buying or else you get financially drained. You must deal with the pattern of not understanding between your wants and needs and know how to deal with the addiction of more wants than needs. To buy somethings, you need to ask yourself critical questions with answers to give you reasons to buy your wants or needs.

USE YOUR TIME WELL

Good usage of time will help manage your need and wants and that is one of the way to balance your needs and wants. Also, how you spend your time matters a lot and what you get exposed to matters too. You need to start spending time on what will help you in achieving your goals and becoming financially free than more time on things that depreciates your net-worth. Now is the time to invest more time on yourself and future to break the paycheck to paycheck lifestyle.

CREATE A BUDGET

You need to create a budget and act on it. With a budget, you can control your needs and wants. You will know what goes out and comes in and where it went. If it takes time and effort to start working on budget, do it to help you have a financial focus. Budgeting makes you financial disciplined, focused and help achieve your financial goals.

FOCUS ON YOUR FINANCIAL FREEDOM

You need to focus on achieving your financial freedom than letting wants to lead you down the drain. You need to start saving and investing as soon as possible to plan for your financial future. Plan for your retirement, start today by plan and thinking of making tomorrow better than wasting it away frivolously today. If you need help to achieve your financial dream, work on it and get the needed help.

CONCLUSION

You now know the wider difference between needs and wants and how it helps influence your financial freedom and existence. If needs are not met your existence is at stake but wants is just for a passing moment that lets you down. the key difference between the two of them is their level of significance.

NEEDS

Most people get jobs or start side hustle to earn money, so they can pay and acquire the things they need. Unless you have an unlimited amount of money, very little people do, you must know your needs so that you can spend your money wisely. Even though we need food and water to survive, we don’t need coke or Pepsi because these things are wants.

These things we truly can’t be without. Some needs don’t cost any money at all – we all need air, but you don’t need to pay for it. Needs are limited because it has a time frame. It also varies between people in different socio- economic system. It is a matter of interest and how you manage it. when your needs are met, in the same process, you start developing other needs, meaning to a level you make and remake your own nature by your desire and hunger for a thing.

When you develop awareness for things, your needs arise, you work to satisfy those needs.

To achieve financial freedom, you must know your needs and know how to budget for them and know how to manage them so as not exceed your spending limit.

WHAT ARE NEEDS?

A need is something that a person must have to thrive. Without it, that person will suffer either physically or mentally. Need is something needed to survive. Needs are things we must have to survive. Needs makes us act for satisfaction. It is necessary for a healthy living and comfortable life. Needs include: clothing (basic, like t-shirts and socks), health care, savings (for an emergency fund and retirement), security, safe environment and many more.

TYPES OF NEEDS

Our needs move from the smallest to the biggest once it is satisfied. When you satisfy the lower needs, your needs grow higher with time.

These are the 5 types of needs:

1) Physiological needs

2) Safety needs

3) Esteem needs

4) Self- actualization needs

5) Social needs

(1) PHYSIOLOGICAL NEEDS

These are needs essential for your survival, your existence will be in danger or extinction if these needs are not met. These needs keep you in good shape and being physiological sound.

Its totally not possible to live shelter, clothing, air, sleep and others. With somewhere to lay your head, you can think, meditate and reason well and feel comfortable.

(2) SAFETY NEEDS

These are needs for your security against infections, deadly diseases and worry less about everything. This can come also in form of job security, retirement plan, insurance plan, planning for financial security.

(3) ESTEEM NEEDS

These are needs to be accepted and valued by others. You want to be accepted and recognized for who you are. These need for esteem leads to being reknown, honesty and many more which is the lower- esteem needs while the higher-esteem needs are a respect for yourself leading to independence, self-confidence and freedom which leads to a level of growth.

(4) SELF-ACTUALIZATION NEEDS

These are needs for actualization, development, growth and desire to take responsibility and become better. Not everyone is interested in these needs just very little percentage who are totally focused and determined to achieve certain goals in life. As you grow and develop yourself, these needs change.

(5) SOCIAL NEEDS

These are needs to love and be loved by everyone around you. The need to be loved and cared for which is more important than the psychological and security needs. It’s a need for a sense of belonging and affection. Friends, families, and relationship is of utmost important to meet these needs.

CONCLUSION

Now you know the type of needs and its impact on you. How psychological needs helps you to be sound in thinking, meditation and decision making. How your psychological needs can affect your finance if well- managed and controlled. With psychological needs, you work towards your safety needs to project and plan for your financial future by saving and investing and budgeting to meet your needs.

You want to have a level of self-esteem and acceptance among people. You want to belong to certain class that have the same mindset as you and get you connected to people of the same network.

Working with people of the same mindset is because of self-development and actualizing your goals through investing in yourself to develop yourself and grow your finance and get better every single day.

Finally, social needs to be in the midst of friends and families to be loved and cared for, you need people to talk to about your financial life or any other area of your life to know where you are and how far you have and how to help you improve and give you ideas and advice to make the best decisions from.

There are things needed for the survival of human being but some of them are not wanted and can be managed, discarded or delay gratification to achieve future financial goals. These things not needed buy occur as emotional need that can be controlled but wants to derail your financial future or you are not being financially aware of its impact.

When you work or earn a living through your job or side hustle, it’s meant for your needs and wants but how you priotized them matters a lot to help manage your finance.

Man has unlimited wants and they come in different forms and things needed to satisfy this desire is limited. If these wants are not controlled, they can lead you to accumulating expenses and it leads to bad debt that leaves you struggling financially.

These wants can rely on your environment, family background, friends and mindset. Character and depth of strength also has impact on your wants and how you manage them goes a long way to yield a better result.

What one-person needs is another person wants. And there are a variety of ways to meet a need or a want. Our wants seem to change due to civilization and new products and services that erode your mind with mind blowing online adverts, bill-boards, posters and many more. If we go with all these flows in the world and listen to all the music playing around you and dance to their tune, they leave you in bad shape and these wants can change on the long run once the desire for that product or service fades out as a result of new influx of product design in the market and many more.

If you desire so much for something for a while and with time that hungers fade off that is WANT because its not a priority and not extremely urgent. They are just things you crave and love but you could do without them if you don’t have the money to buy them and can also do without them but if you have the money and it adds no value, you emotionally control yourself, so that it won’t form an habit.

Most companies rely on your hunger for things to design products that leads to our emotional buy because we want them and lots of people go extra- mile to get these things that are not needed.

The trick to investing, saving money, and reaching your financial goals is to make sure you’re wisely balancing your long-term needs and your short-term wants to allow you live well frugally, and find joy and contentment in life. There is no formula for that as only you can determine which compromise you are willing to make.

Is it that it is bad to enjoy the good things of life? No. but have a level of discipline, commitment and focus to know what you want, how to curb, control and cut the unnecessary ones to help plan, budget your finance to achieve your financial freedom.

WHAT ARE WANTS?

A want is a choice. A desire which a person may or may not be able to get. A want is a desire to have a product or service immediately or near future, that may, or may not, be able to obtain.

With these two definitions, there is not much to discuss on this definition.

When you look deep into your finance or become financially aware of where you are or why you struggle you realize that you desire for too many wants that you end up acquiring without knowing much about it.

Wants are electronics, jewelry, clothing (non-necessities – designer sneakers, video games and many more. These wants derails you from your financial goals most times and you are in-depth into it without being aware of the financial consequences.

You really desire that designer T-shirts and sneakers that just got launched but you just bought T-shirts and sneakers months ago, but you keep desiring to have this new product with its exceptional design and style. With this hunger to acquire this want, you might likely hunger more for the latest designs which put you in financial traps and increase your expenses.

THREE TYPES OF WANTS

The three types of wants are:

1.) Necessity

2.) Comfort

3.) Luxuries

NECESSITY

There are wants that makes you alive and if you do not have these things you can’t live on earth and you can’t do without them. They are water, food, clothes, house and many more. You need to eat to be alive. You need shelter over your head and you want water to quench your thirst. All these wants are important for your well-being.

COMFORT

Without comforts, you can’t live. Only comforts give makes life conducive and better for you. It makes you more efficient and effective. Table, chairs, bed, fan, computers and many more. These wants makes us desire comfort.

LUXURIES

Luxuries surfaces when you are living comfortably. After dreaming of many things, you want to live in exclusive house, drive an expensive car and live the high standard of living. These desires are luxury and reduces your value.

7 THINGS TO KNOW ABOUT WANTS

1.) WANTS ARE INSATIABLE

Your wants are never completely meet or satisfied and will never be, as long as you are alive. Once you quench the test for one, another one erupts, and this is an unending cycle. If you buy that flashy car three to six months ago, there’s probability of you disposing that car to acquire the latest car to show off or meet up to the standard of your pairs.

2.) WANTS ARE SATIABLE

No matter how large that want is, it is satiable if you have the resources to and the desire can be curbed to control the wants. If you want that product and you have the money, surely you will get it.

3.) WANTS VARY WITH PLACE AND TIME

Want changes as time does with individual wants. People want different things in different place and in different times too.

A man in one country wants a car and another in different country also wants a car too but they are not the same because of what both men want in the car.

4.) WANTS CHANGE DUE TO MODERNISATION

With modernization, the wants of people have changed and their desire have increased too. The wants of people in the village and city is not the same. The wants of people in the city desires the latest of every new product released and that hunger is extremely growing and insatiate.

5.) WANTS BECOME HABITS

Once you desire for a particular wants all the time and you try to satisfy it but this hunger do not quench, it becomes an habit that causes financial woes for you.

6.) WANTS ARE INFLUENCED BY YOUR EARNINGS.

When your income increases, your mind tells you, you need to live up to the standard of your new status and your wants also changes too, you want to meet this new desire to living to the standard of your pairs.

7.) WANTS ARE INFLUENCED BY ADVERTISEMENT

Our wants can be influenced by the bill-board, posters and online adverts you see and start desiring to have them because the image of that product has been captured by your mind and your emotions are already attached to it.

CONCLUSION

With these, you know what wants are, the types of wants and how wants influence your hunger for things and how it makes you buy things frivolously and what to do to curb, manage or cut down your wants.